Calculation of Bank Nifty weightage & its formula with examples

Indian Indices Bank Nifty or Nifty Bank Index is comprised of the 12 most liquid and large capitalized Indian Banking shares of NSE . This Indian Index of Share Market has attracted a lot of attention in the world of option trading in recent years. It provides investors and market intermediaries with a benchmark that captures the capital market performance of Indian Banks stocks listed on the National Stock Exchange (NSE). Its composition is reviewed and adjusted semi-annually to ensure it accurately reflects the performance of the sector.

We, specially F&O trader (Future & option trader), have experienced volatile nature of this Index as compared to any of its constituents but ever thought why this Index behave like this?

To know this, we must know what are its Components / constituent and how the changes in Bank Nifty calculated?

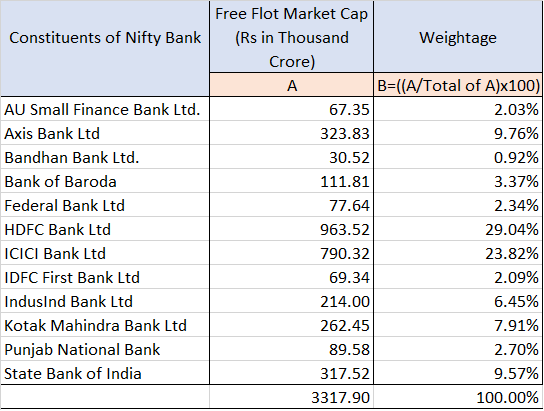

At First Bank Nifty has 12 constituents having different weightage. And the weightage is determined by its free float market capital. Free Float market capital again means Value of shares available for public trading. We Can take example of data of 30th April (As NSE adjusted the weightage on this date) to understand the calculation of How Weightage and Bank Nifty points calculated.

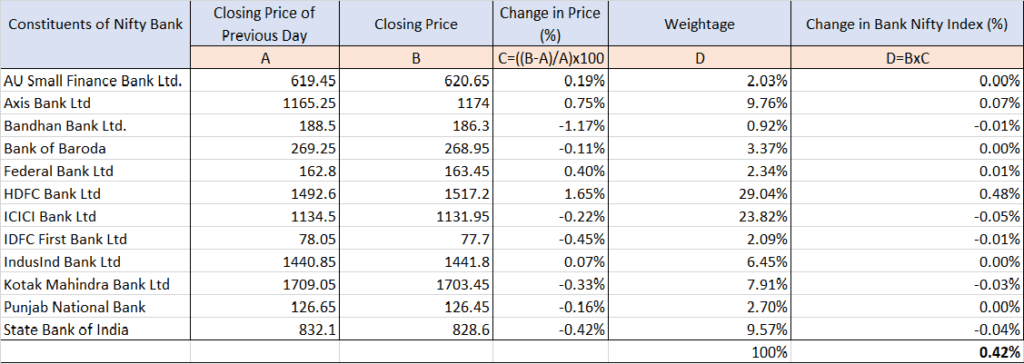

Now next step is multiplying weightage of every constituent to the change in % of the constituents as in below table. (Here we can take Today’s data)

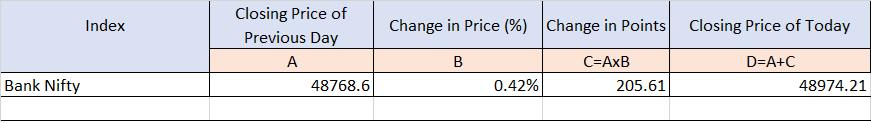

And Now we got the Percentage change in BankNifty Index, which is 0.42% and we can determine the change in points in Bank Nifty and Closing Bank Nifty in following manner:

Now we got the closing Bank Nifty as 48974.21 (may differ few points due to rounding off)

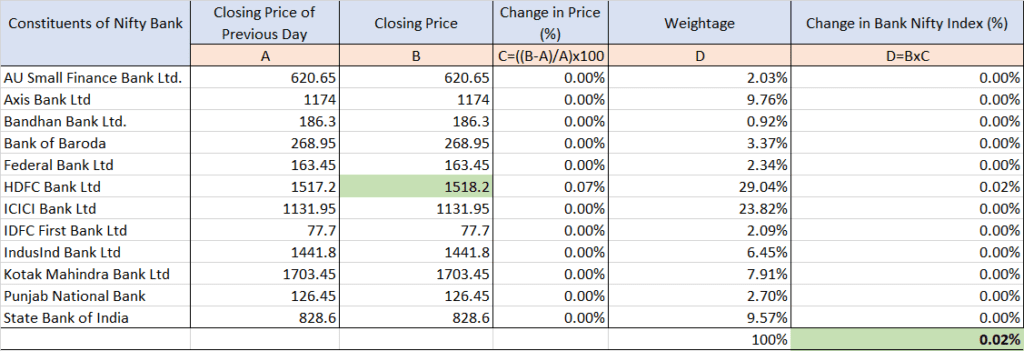

This method is known as free float market capitalisation method. And for this unique method of calculation a single Re change in HDFC Bank, can move the Index almost 10 points. Which we can see in the table below.

We can see on above table, highlighted with green, how a single Re change in Share of HDFC Bank Ltd, can move the Index by 0.02% i. e. 0.02% of 48767.6 = 9.75 points. And if HDFC Bank would move 1% the Bank Nifty Index will move 0.2904% i. e. 0.2904% of 48767.6 = 141.62 point.

In above example we have assumed that Other Constituents of the BN Index remain unchanged.

Source : NSE India

Link to Read our Top Article:

- Agriculture Sector: Best Stocks in Agro Sector

- Liquor Sector: Best Alcoholi Stocks in India

- Railway Sector & Rail Stocks in India

- IT Sector: Best it stocks in india

- FMCG Sector: Top FMCG Stocks in India

- Indian ADR Stocks

- Renewable Energy Stocks India

- Semiconductor Stocks in India

- 10 Top EV Stocks in India – Best EV Penny Stocks list in India

- Investment in International Stock Market: Advantages & Associated Risks

- Global Investment

- INDIA VIX

- Dollar Index (DXY / USDX)

- Bank Nifty Calculation & Formula

- Top 10 Auto Stocks & the Sector in India: Trends and Opportunities